Cheque at a ll EPF counters in state capital including KWSP Muar. There are many advantages of EPF Self Contribution.

Summary Of Case Study On Employee Provident Fund Of Malaysia

This post is about EPF Self Contribution.

. Update. Government contribution is limited to members who are below age 60. What you need to know.

Register with the EPF as an employer within 7 days upon hiring the first employee. Life Insurance EPFApproved Scheme Life Insurance For Retired Public Servants RM7000. 20 sen RM50 to RM70.

Calculate your salary EPF PCB and other income tax amounts online with this free calculator. Increase up to 15 for Employer EPF Contribution. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia.

Register your employees as EPF members and keep their information updated. March 6 2020 at 321 pm. Not applicable to members that receive a fixed employer contribution.

Since 2020 the default. The application for employees to contribute above the statutory rate will be in effect from January 2021 wages OR for wages on the month. I-Saraan Kasih Suri Keluarga Malaysia KWSP Top-up Savings Contribution effective January 2013 What You Need.

However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021. Pensionable public servant category Life insurance premium. Feel free to bookmark the page.

Click on the lower right button and back to the classic. Mobile team near you. 21 thoughts on Free Payroll Software for SMEs Malaysia.

Most of us know or at least heard of EPF Employees Provident Fund which is also known as KWSP Kumpulan Wang Simpanan Pekerja in the local Malay languageBecause employers and employees in Malaysia must contribute a portion of their monthly salary to EPF savings as a retirement fund. Collect your employees share of EPF contribution and submit it to the EPF along with the employers share. Life insurance and EPF INCLUDING not through salary deduction.

New Kpj Jobs in Malaysia available today on JobStreet - Quality Candidates Quality Employers. Besides we can get tax relief up to RM 6000 under Life insurance and EPF types. 000 and 13 for salaries lower than that cause the free version salary more than RM5000 still calculate as 13 for EPF Employer contribution.

Provide salary statements to employees. Yearly Increment and Bonus. 10 sen RM30 to RM50.

Job Specializations Healthcare PractitionerMedical Asst. EPF Contribution Rates for Employees and Employers After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000.

EMPLOYER CONTRIBUTION CARUMAN MAJIKAN TOTAL CONTRIBUTION JUMLAH CARUMAN Up to RM30. OTHER than pensionable public servant category Life insurance premium Restricted to RM3000 Contribution to EPF approved scheme Restricted to RM4000 7000 Restricted 19. Thousands of Malaysians use our free Online Salary Calculator Malaysia that also calculates EIS EPF SOCSO PCB MTD.

Log in to Reply. Job search MyJobStreet Company profiles Career advice. The dividend rate of the EPF is always higher than Fixed Deposit Rate provided by bank.

I-akaun member i. Gain peace of mind as our PCB calculation and EPF contribution rates are updated and accurate as of 2022. However those who fall under this group do not qualify for EPF contribution reliefs.

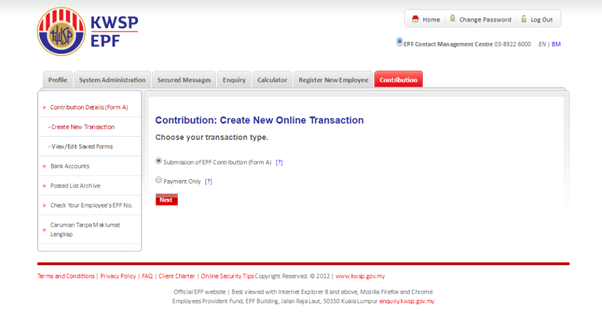

If you are interested to know the calculation of the EPF contribution formula you have came to the right place. Step By Step Pay EPF Online. Despite employees being able to submit the Borang KWSP 17A Khas 2021 form as early as 01122020 employers are only allowed to upload VEKHAS2021 csv file on i-Akaun Employer starting from 14122020.

Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55. For Malaysia Residents Non-Residents Returning Expert. Retired public servants receiving a pension can claim tax relief of up to RM7000 for their life insurance premiums.

5 Ways To Grow Your Epf Savings In Malaysia

Epf Justlogin Malaysia Payroll Justlogin Help Center

St Partners Plt Chartered Accountants Malaysia Epf缴纳率下调至7 的可要注意了 Reduction Of Statutory Epf Contribution Rate From 11 To 7 Employers Are Required To Use The Amendment Third Schedule As Follows For

Confluence Mobile Community Wiki

Survey Epf Tops List Of Most Trusted Companies Among Malaysians For 2021 Trailed By Bnm Petronas

Malaysia Keeps Epf Employee Contribution Rate Below 11 Pensions Investments

Employees Provident Fund Malaysia Wikiwand

Confluence Mobile Community Wiki

Recognising Employer Partners In Malaysia

5 Ways To Grow Your Epf Savings In Malaysia

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Summary Of Case Study On Employee Provident Fund Of Malaysia

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Epf Launched New Initiatives To Assist Employers Businesstoday

Malaysia Epf Statutory Contributions Reduction Activpayroll

Epf Will Align Employer Employee Contribution With The New Minimum Wage Order